Unfair Contract Terms

Section 1: Definitions and Examples

What are unfair contract terms?

Consumer contracts are formed with every good and service supplied to consumers. Normally the contract would be of standard form prepared by the business and would contain generic terms and conditions which are non-negotiable.

It is important that these contracts are fair and do not result in an imbalance between the rights and obligations of the consumers and those of the sellers and suppliers. If the contract terms place an oppressive or exploitative burden to the consumer, the contract can be considered unfair. In many countries, the unfair terms in such contracts are considered void or no longer binding to the consumers.

Most contracts work out fine. However, some contract terms may be unfair. This arises because of ignorance or in the interest of profit-making, businesses may set out to harm consumers by avoiding liability for the safety, performance or durability of the goods and/or services they offer. This can place an oppressive or exploitative burden to consumers and result in a significant imbalance between the rights and responsibilities of consumers and businesses.

Consumer protection and related laws help ensure that consumers are not forced to accept all the terms of a contract without the opportunity to change them and safeguard their interests. The relevant legal provisions either list banned or questionable terms, or they set out a test of reasonableness to check whether terms are fair to all parties. In many countries, unfair contract terms are considered void or no longer binding to both the consumers and businesses.

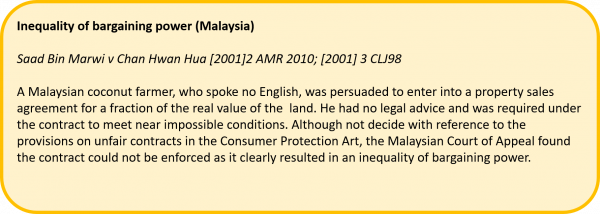

What are common examples of unfair contract terms?

It is hardly possible for consumer protection and related laws to list all examples of unfair contract terms. A lot of laws therefore require the determination of unfairness by a court or tribunal. In many countries, databases exist to reference examples of unfair contract terms (and case law). These serve as guidance for consumers and businesses on how to spot unfair contract terms and avoid using them in consumer contracts.

Figure 1 Examples of Unfair Terms

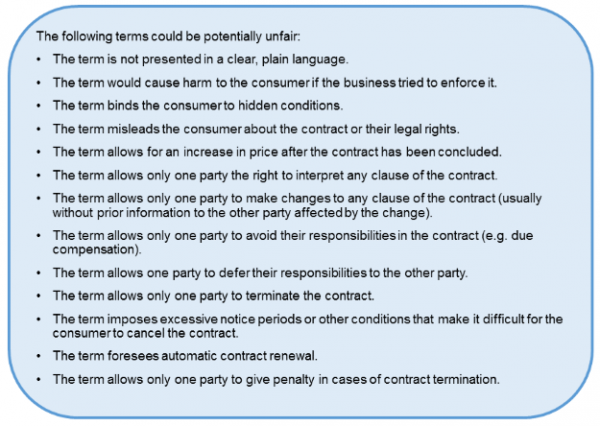

Guidance: Templates for standard contracts

In an ever-growing and more complex market place, standard contracts are becoming the norm. They can be an efficient solution for businesses that may not have the resources to provide consumers with an opportunity to negotiate individual terms and conditions. Aside from enforcement activities, consumer protection agencies can provide guidance to businesses in the form of templates for standards contracts (terms and conditions).

Figure 2 Example of a Standard Contract

Section 2: Provisions on Unfair Contract Terms in ASEAN

- Brunei Darussalam

Unfair contract terms are regulated by the Unfair Contract Terms Act (Chapter 171 of Laws of Brunei Darussalam). It came into force on 3rd May 1994 with the objective of limiting the extent to which civil liability for breach of contract, or for negligence or other breach of duty can be avoided by means of contract terms. The Act sets out prohibited unfair contract terms and the exemptions.

In addition to this, definition of unfair practice under the Consumer Protection (Fair Trading) Order, 2011 (CPFTO), which came into force on 1st January 2012 includes taking advantage of a consumer by including in an agreement, terms or conditions that are harsh, oppressive or excessively one-sided so as to be unconscionable.

- Cambodia

Cambodia has yet to enact a national consumer protection law. However, the Law on the Management of Quality and Safety of Products 2000 (LMQSP) contains mandatory rules that affect all consumer contracts, specifically on health and safety, along with a strict liability regime for breaches of the law. The LMQSP also contains provisions requiring accurate information, prohibitions on deception, requirements for quality certification and provisions for the repression of fraud, but there are no specific measures related to contracts. - Indonesia

The Law No. 8 on Consumer Protection 1999, in Chapter V Article 18 contains “Provisions in the Inclusion of Standard Clauses” that prohibit the following in any document, agreement or contract between businesses and consumers:- Terms that allow transfer of liability from businesses to consumers

- Terms that reserve the right to refuse receiving back the goods already purchased by the consumer

- Terms that reserve the right to refuse refunding for the goods and/or services already purchased by the consumer

- Terms that gives the authority to the businesses from the consumers to carry out directly or indirectly all unilateral actions with regards to the goods purchased on installer the consumers

- Terms that regulate the authentication of proof on the loss of goods or utilization of services purchased by the consumers;

- Terms that allow businesses to reduce benefits of the services or consumer’s assets being the object of sale and purchase of the service concerned

- In case of goods/services purchased on instalment, terms that impose unilateral actions and additional/amended regulations without prior notice upon a consumer

- Terms that states the consumers give authority to the businesses to impose mortgage, pledge or guarantee against the goods purchased on instalment by the consumer.,

- Lao PDR

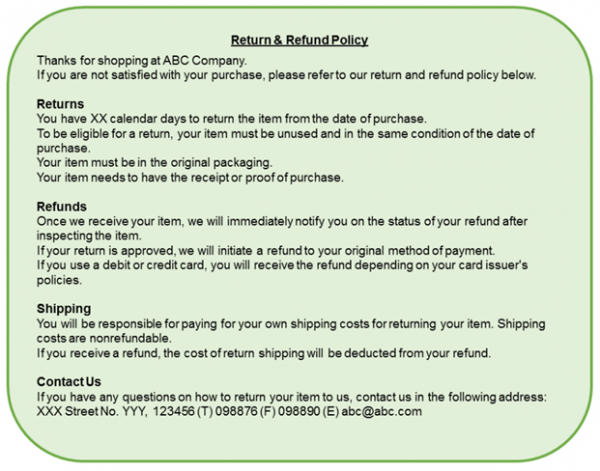

The general consumer protection law for the Lao PDR is the Consumer Protection Law 2010 (CPA), which has no provisions on unfair contract terms. There is no separate legislation regarding unfair contract terms. - Malaysia

Malaysia does not have a separate legislation on unfair contract terms, but the Consumer Protection Act 1999 (CPA) includes provisions dealing with aspects of unfair contract terms. Part IIIA of the CPA defines unfair contract terms as an imbalance of rights between consumers and businesses. The CPA seeks to prohibit clauses excluding liability in standard form contracts. It defines “unfairness” in terms of an imbalance of rights and obligations, providing for both procedural and substantive unfairness. Clauses in breach of Part IIIA are considered void or unenforceable, with the possible consequence of criminal and civil penalties. Much of the judgement of unfair contract terms of found in case law. - Myanmar

Myanmar enacted the Law on Consumer Protection 2014 (LCP), but amended the law in 2019. Although there is no separate statute regulating contract terms, the LCP contains general consumer protection provisions regarding deception and disclosure, albeit not unfairness. Additional regulations that touch on contracts include the Contract Act 1872, Sale of Goods Act 1930 and the Specific Relief Act 1877. These acts include provisions relating to fraud, mistake and misrepresentation. - Philippines

There is no separate unfair contract terms law in the Philippines, yet unfair or unconscionable sales acts and practices in relation to consumer transactions are regulated in Article 52 of the Consumer Act of the Philippines 2014 (Republic Act No 7394). The Act provides for the circumstances in which practices may be deemed unfair or unconscionable, defining them as any act which takes advantage of consumers to enter into a transaction that is “grossly inimical to the interests of the consumer or grossly one-sided in favour of the producer, manufacturer, distributor, supplier or seller”. This includes circumstances in which consumers are vulnerable due to a lack of information, as well as exploitative practices towards consumers with disabilities and illiteracy. Though specifically focusing on procedural unfairness, prohibitions on substantive unfairness are covered as well. - Singapore

The main statute that contain provisions relating to unfair contract terms is the Unfair Contract Terms Act (Cap. 396, 1994 Rev Ed) (UCTA).

The UCTA seeks to impose further limits on the extent to which civil liability for breach of contract, or for negligence or other breach of duty, can be avoided by means of contract terms. This follows a test of reasonableness.

The Consumer Protection (Fair Trading) Act (Cap. 52A, 2009 Rev Ed) (CPFTA) seeks to protect consumers against unfair trading practices. Under the Second Schedule of the CPFTA, two specific unfair practices relate to unfair contract terms:- Unfair Practice 11 – Taking advantage of a consumer by including in an agreement terms or conditions that are harsh, oppressive or excessively one-sided so as to be unconscionable.

- Unfair Practice 20 – Omitting to provide a material fact to a consumer, using small print to conceal a material fact from the consumer or misleading a consumer as to a material fact, in connection with the supply of goods or services.

- Thailand

In addition to the its general law, the Consumer Protection Act 1979 (CPA), Thai consumers are further protected in Thailand by laws on product liability, redress and direct sales. Provisions on unfair contract terms are dealt with under the CPA as well as the Unfair Contract Terms Act 1997 (UCTA). While the CPA empowers an administrative body to rule on particular contractual terms and prohibit their enforcement against consumers, the UCTA allows judicial supervision of commercial conduct and the voiding of unfair terms.

The key principle underpinning the UCTA is to preserve the principle of the ‘’autonomy of will’’ and ‘’freedom of contract’’. In its Section 4, the UCTA stipulates that terms of contracts can only be enforced against a consumer if they are ‘’fair and reasonable in all the circumstances’’. This is followed with a list of conditions that are considered to be unreasonable terms such as: unreasonable dominance, exclusion of liability, unfair contractual burden on consumers, arbitrary termination, contracting out of conditions, unfair compensation terms, punitive default provisions and the use of exploitative compound interest arrangements. - Vietnam

Contracts between traders and consumers, along with general trading conditions, are addressed in the Law on Consumer Protection 2011 (LoCP). Under Article 14 of the LoCP, the language of a written contract must be clear and easily understood. Furthermore, the language of the contract must be in Vietnamese, unless the parties or the law provides otherwise. Traders must make it easy for consumers to review electronic contracts in their entirety prior to execution. The law also specifies clauses and general trading conditions that are invalid, such as a clause that allows the trader to assign rights and obligations to a third party without the consumer's consent.

The LoCP focuses on standard form contracts. If traders conduct business in products or services that appear on a list of essential products and services promulgated by the Government, they must register a standard form contract and general trading conditions with the Viet Nam Competition and Consumer Authority (VCCA). The VCCA has the discretion to rescind or amend, or require the trader to rescind or amend, a standard form contract or general trading conditions which breach consumers' rights. Furthermore, implementing regulations specify general requirements for standard form contracts, general terms and conditions, along with registration procedures and forms. The VCCA regularly monitors the compliance.

Key Features of ASEAN Unfair Contract Laws

Section 3: Database and Case Studies